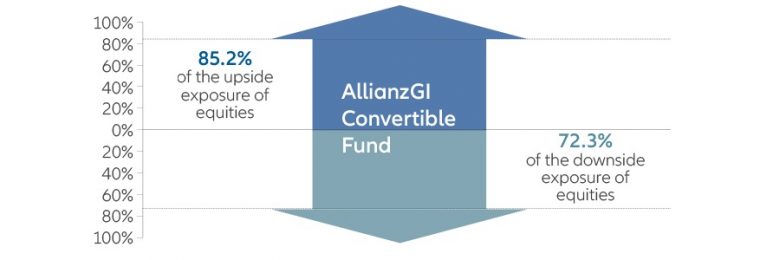

The AllianzGI Convertible Fund is touted by fund managers as producing better returns than stocks while having less risk. Don’t believe everything fund managers tell you. In spite of investors thinking that corporate bonds are generic, they do come in several different flavors, including convertible bonds. Convertible bonds are called that because they start out […]

The pandemic has hit retailers particularly hard, and this is a sector that was already in considerable distress. Macy’s seems to be doing their best to survive, but don’t get too excited. Before we decided not to allow retail stores to remain open due to fears of the COVID-19 pandemic, the retail sector was already […]

Even though the stock market gets a lot more attention, the bond market is roughly twice as big. We look at the three main types of bonds and how they have fared this year. It is standard practice for investors to hold a certain percentage of their portfolios in bonds, seeking to offset the risk […]

As paltry as the returns from municipal bonds are, at least compared to stocks, they still attract a lot of investment, due to investors thinking that they are so safe. Think again. We’ve been worried for a while about the potential hit that municipal bonds, or munis, could take from this economic shutdown, and we’re […]

Legendary hedge fund investor Ray Dalio is particularly known for his understanding of bonds, and has made billions from them. He now thinks that it is “crazy” for investors to hold them. Ray Dalio’s story is a true rags-to-riches one, where he quit his job one day to venture off on his own with just […]

The Federal Reserve normally confines its bond buying to U.S. treasuries, and its buying corporate bonds is a big departure. Buying corporate junk bonds is even more so. The Federal Reserve Bank of the United States normally only seeks to manage the economy by taking actions that either increase or decrease the country’s money supply, […]

David Hammer of bond king Pimco is doing his best to drum up more interest in municipal bonds. Their little scare may be over, but there’s little to be excited about here. There are three main types of bonds that people can invest in, which are sovereign bonds issued by federal governments, such as U.S. […]

Back on January 24, the stock market began to buckle under the force of the coronavirus, we told you it was time for gold, but bonds have been picking up as well. Investors tend to hold a lot of bonds, presumably for a rainy day, although given that the sun shines most of the time, […]

It is said that there are eight million stories in the Naked City, some more naked than others. The one about yields putting a lid on stock growth is about as naked as they come. We always have our eyes open to what is happening in the financial world, which includes looking at what other […]

Bond funds have had a big target on their back after their peak last summer. Bonds had a great first 8 months of 2019, and the outlook has changed, but not for Ned Davis. It was no secret that after bonds peaked last August that we were in for a correction. With stocks, you need […]