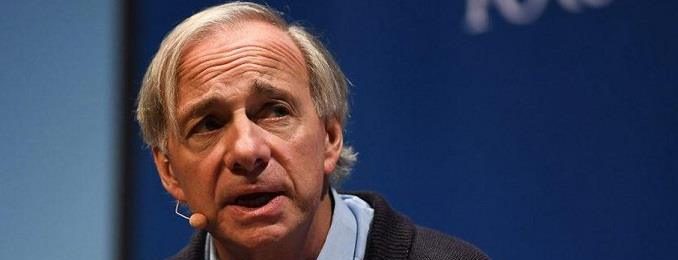

Ray Dalio, the owner of the world’s largest hedge fund, is a capitalist if there ever was one. When he says that capitalism is broken and is in need of a fix, that may say something. Ray Dalio isn’t just an expert on macroeconomics, he made his fortune directly from this knowledge, all $18.4 billion […]

2019 has started out pretty bullish for the overall stock market, but with many health care stocks, it’s been a year to forget so far. Things don’t look like they are changing. United Health Care serves as a good example of how health care stocks are starting to really get swatted by the bears out […]

Trading in options is far from the beaten path of your typical investor, especially selling them. Some investors do use this strategy though, but they can be plenty tricky. The world of options trading is a complex one to say the least, about as far as you can get from your normal buy and hold […]

BlackRock’s earnings come in a little short of expectations, but the ETF market that they dominate is still red hot. The company is also seeing a real potential for further market gains. It is earnings season again, and when we are looking at the earnings of the world’s largest fund company, or money manager of […]

While investors normally applaud increases in wages, as this does indicate a growing economy, Morgan Stanley analysts are concerned that this may even contribute to a recession. Seeing both a growth in jobs and a growth in wages is something that investors find pretty appealing, as these are inflationary pressures that stimulate economic growth. The […]

According to U.S. President Donald Trump, the stock market should be 10,000 points higher than it is today if not for the Federal Reserve not acting to support its growth enough. Whether or not people think Donald Trump is sufficiently qualified or suited to be President of the United States is to a large degree […]

ETF business is booming, and is now a $4 trillion a year industry. 80% of ETF business is concentrated in just 3 firms, with more than a hundred other firms fighting for the scraps. Exchange traded funds, known as ETFs for short, have made huge inroads into the realm of investing, and are even getting […]

Current projections have us moving from a 2.9% GDP growth rate in 2018 to around just 2% in 2019, and stay around this level until 2022. What does this mean for stocks? There’s no question that the growth of our economy is slowing down lately. The predictions of it dropping to around the 2% level […]

The stock markets may be up about 20% on average in 2019, but CVS is down that much this year so far, and down 34% since mid-November. There are reasons to be hopeful though. Investors love buying hot stocks, at least the armchair ones. There is a lot to be said about buying a stock […]

Retailer Bed Bath and Beyond has put in a nice rally so far in 2019, after being on a huge slide the last 4 years. Things don’t look quite as promising as we had hoped though. Bed Bath and Beyond has simply been a horrible stock over the last 4 years. For the first half […]